seemetric.ru

Prices

Life Stream Loans Review

They wasted my time, and hands down have the worst customer service I have ever experienced in my life! We'll help you lock in a competitive rate to finance your next new or used car, or finance a lease buy-out. All loans are subject to credit approval. LightStream loans can be a good pick for people with strong credit who are looking for competitive interest rates, no fees and potentially quick funding. Its. Review the final loan document. Ask Refinancing an existing loan may result in the total finance charges being higher over the life of the loan. Excellent service The loan application was easy and fast. I had my funds in less than a week! 5 out of 5 stars. Loans for life events & everything else: Adoption or fertility treatments review and electronically sign your loan agreement; (2) provide us with. LightStream's loans are among the best for borrowers with strong credit, featuring generous amounts and repayment terms, low APRs and no fees. The good thing about having an unsecured auto loan is that you, as the buyer, receive the car title immediately. Your credit score and financial position gives. LightStream earned an A rating from the Better Business Bureau and out of 5 stars from Trustpilot, based on 77 reviews, which is considered bad. The. They wasted my time, and hands down have the worst customer service I have ever experienced in my life! We'll help you lock in a competitive rate to finance your next new or used car, or finance a lease buy-out. All loans are subject to credit approval. LightStream loans can be a good pick for people with strong credit who are looking for competitive interest rates, no fees and potentially quick funding. Its. Review the final loan document. Ask Refinancing an existing loan may result in the total finance charges being higher over the life of the loan. Excellent service The loan application was easy and fast. I had my funds in less than a week! 5 out of 5 stars. Loans for life events & everything else: Adoption or fertility treatments review and electronically sign your loan agreement; (2) provide us with. LightStream's loans are among the best for borrowers with strong credit, featuring generous amounts and repayment terms, low APRs and no fees. The good thing about having an unsecured auto loan is that you, as the buyer, receive the car title immediately. Your credit score and financial position gives. LightStream earned an A rating from the Better Business Bureau and out of 5 stars from Trustpilot, based on 77 reviews, which is considered bad. The.

Loans for life events & everything else: Adoption or fertility treatments review and electronically sign your loan agreement; (2) provide us with. LightStream personal loans are best for individuals looking for debt consolidation with good to excellent credit. Check out the pros and cons of this. over the life of the loan. It may well be coupled with one or more of loan review, loans that had been reviewed at previous examinations that had. Review of Monetary Policy Strategy, Tools, and Communications. Overview Stream TypeLIVE. Remaining Time Playback Rate. 1. Chapters. Chapters. LightStream has been accredited by the Better Business Bureau since , earning an A+ rating, and its personal loans received a /5 rating from WalletHub. LightStream loans can be a good pick for people with strong credit who are looking for competitive interest rates, no fees and potentially quick funding. Its. Stream Type LIVE. Seek to live, currently behind liveLIVE. Remaining Time 1x. Playback Rate. Chapters. Chapters. Descriptions. descriptions off, selected. If you have good or excellent credit and you're looking for a no-frills inexpensive loan, LightStream is a good bet. It offers same-day funding and. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Congratulations, Class of ! Celebration Site · Live Stream. Ceremony details. Ceremony detailsHow to graduateVenueBlack. It's nice to have a loan company that will reward and trust you for having good credit. The loan process was easy and safe, with great rates and no early payoff. They wasted my time, and hands down have the worst customer service I have ever experienced in my life! I informed ***** to cancel my loan agreement IMMEDIATELY. LightStream Personal Loans offer low APRs, no fees and the ability to apply online, making it Select's top choice for best overall personal loan. When you get a LightStream debt consolidation loan, it's a streamlined online loan process that gives you the choice of your funding date and repayment terms. Review the final loan document. Ask Refinancing an existing loan may result in the total finance charges being higher over the life of the loan. I used to be a customer and they used to be great. My latest experience has been terrible. They requested documents over and over again. Their online syst didn'. Users on a mobile device must click 'Start Mobile Live Stream' to access the live stream. Review Working Group · Agenda (HTML)for Strategic Opportunities. Enable backend services so that they're live and accessible during review (ix) Apps offering personal loans must clearly and conspicuously disclose all loan. Beyond home improvements, LightStream loans can be competitive for anyone who qualifies. The lender offers relatively high loan amounts, flexible terms, and. Lending Stream short term loans are a responsible payday loan alternative with 6 months to repay. Apply now, loans sent to your bank in 90 seconds.

Business Gas Cards Without Personal Guarantee

Earns rewards on all purchases · Available for fair credit · No annual fee · No foreign transaction fees · Free employee cards. BUSINESS CARD W/ NO PERSONAL GUARANTEE AND INQUIRY. Hi,. Looking for recommendations of business credit cards that i can apply for under my. Summary of the Best Business Credit Cards Without a Personal Guarantee Requirement. BUSINESS CARD W/ NO PERSONAL GUARANTEE AND INQUIRY. Hi,. Looking for recommendations of business credit cards that i can apply for under my. Unlike business credit cards, corporate credit cards don't require a personal guarantee from the business owner. Eliminating personal guarantees from a. Business cards often have minimum credit score requirements, especially for non-incorporated businesses. That's because your personal guarantee as the owner is. If you're uncomfortable with the idea of a personal guarantee, you may wish to explore business credit cards with no personal guarantee as an option. It really is hard to find something that you can get lines of credit with when you've got shit personal credit and no business credit. The fuel. SVB Innovators. The SVB Innovators Card is another no personal guarantee credit card, that like Brex, works like a charge card where balances must be paid in. Earns rewards on all purchases · Available for fair credit · No annual fee · No foreign transaction fees · Free employee cards. BUSINESS CARD W/ NO PERSONAL GUARANTEE AND INQUIRY. Hi,. Looking for recommendations of business credit cards that i can apply for under my. Summary of the Best Business Credit Cards Without a Personal Guarantee Requirement. BUSINESS CARD W/ NO PERSONAL GUARANTEE AND INQUIRY. Hi,. Looking for recommendations of business credit cards that i can apply for under my. Unlike business credit cards, corporate credit cards don't require a personal guarantee from the business owner. Eliminating personal guarantees from a. Business cards often have minimum credit score requirements, especially for non-incorporated businesses. That's because your personal guarantee as the owner is. If you're uncomfortable with the idea of a personal guarantee, you may wish to explore business credit cards with no personal guarantee as an option. It really is hard to find something that you can get lines of credit with when you've got shit personal credit and no business credit. The fuel. SVB Innovators. The SVB Innovators Card is another no personal guarantee credit card, that like Brex, works like a charge card where balances must be paid in.

Brex cards have expense management built in — because a card without controls is, well, out of control. Brex does not guarantee any third-party product. unsecured credit cards like Visa, · at Shell gas stations and · christmas ornaments seemetric.ru 4. Credit Cards Worth Applying For · needed Brex does not ask · Fuel Cards for Small Businesses · WebNov 27, This card · be sold in a timely · business credit. 2. If you are a fairly large business with a consistent revenue of $1 million or more, the bank might waive off the personal guarantee. However, you need to be. Generally, most lenders require a personal guarantee by the business owner before issuing a business credit card. U.S. BANK BUSINESS TRIPLE CASH REWARDS CARD. Earn $ in cash back. Plus, earn 3% cash back on gas. U.S. BANK BUSINESS PLATINUM CARD. Get a low intro APR. Check Mark No personal guarantee. Check Mark Won't affect your credit score The wordmark COAST® for fuel payment cards as embodied by U.S. trademark. Best Business Credit Cards With No Personal Guarantee · Brex Corporate Card for Startups · Ramp Business Card · Sam's Club® Mastercard® · SVB Innovators Card. Business Gas Cards without Personal Credit ; · melmoneygal. · · veryconceitedboutique ; K · jdfundinggroup. · · ceosdaily ; K. price for using a credit. Business Gas Credit Cards Without Personal Guarantee of any kind, such as annual fees, foreign transaction. Earns rewards on all purchases · Available for fair credit · No annual fee · No foreign transaction fees · Free employee cards. Having no personal guarantee on a business credit card means you're not personally liable for any of your business debts. Having no personal guarantee isn't the. Start saving more on fuel. Competitive discounts. No PG needed to apply. Apply now and get your new fuel card approved in 1 day. In addition to no hidden fees, look for business gas cards that offer low administration fees. Check Mark No personal guarantee. Check Mark Won't affect your. ExxonMobil's business gas cards can help you take charge of fueling costs Points have no monetary value and expire after 1 year. You cannot earn. Choose the right small business fuel card with confidence · 95%. acceptance at U.S. gas stations · 80%. acceptance at U.S. charging stations · 45, acceptance. Beyond that, a gas credit card can act as an insightful financial tool that helps you manage the entire expense category of fuel. Not only does the card give. Check Mark No personal guarantee. Check Mark Won't affect your credit score The wordmark COAST® for fuel payment cards as embodied by U.S. trademark. Shell fleet cards offer businesses convenient, safe ways to purchase gas and fuel for your fleet. Shell has fuel cards with rewards and rebates. Of course, there are some lenders that will offer you business credit cards if you are a brand-new business without any assets or qualifications, but these are.

Stock Price Of Blink

:max_bytes(150000):strip_icc()/BLNK-22_Jul_2020_11_02-247c1e14beee4a859f7f6d3752ded42e.png)

The current price of BLNK is USD — it has decreased by −% in the past 24 hours. Watch Blink Charging Co. stock price performance more closely on the. The Blink Charging Co. stock price is closed at $ with a total market cap valuation of $ M (M shares outstanding). The Blink Charging Co. is. Blink Charging Co BLNK:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date11/16/23 · 52 Week Low · Blink Charging Co. (seemetric.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Blink Charging Co. Blink Charging Co. historical stock charts and prices, analyst ratings, financials, and today's real-time BLNK stock price. Blink Charging Co. ($BLNK) Stock Forecast: Down % Today. Morpher AI identified a bearish signal. The stock price may continue to fall based on the momentum. Blink Charging Co (BLNK) has a Smart Score of 4 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Blink Charging Co. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Blink Charging is no longer overvalued and may now have upside for investors. Why Blink Charging Stock Jumped Nearly 30% This Week. The current price of BLNK is USD — it has decreased by −% in the past 24 hours. Watch Blink Charging Co. stock price performance more closely on the. The Blink Charging Co. stock price is closed at $ with a total market cap valuation of $ M (M shares outstanding). The Blink Charging Co. is. Blink Charging Co BLNK:NASDAQ · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date11/16/23 · 52 Week Low · Blink Charging Co. (seemetric.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Blink Charging Co. Blink Charging Co. historical stock charts and prices, analyst ratings, financials, and today's real-time BLNK stock price. Blink Charging Co. ($BLNK) Stock Forecast: Down % Today. Morpher AI identified a bearish signal. The stock price may continue to fall based on the momentum. Blink Charging Co (BLNK) has a Smart Score of 4 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund. Blink Charging Co. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Blink Charging is no longer overvalued and may now have upside for investors. Why Blink Charging Stock Jumped Nearly 30% This Week.

Stock analysis for Blink Charging Co (BLNK:NASDAQ CM) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Stock Data · Quote · Charts · Historical Data · SEC Filings · All SEC Filings Price History. Blink Charging Co. NASDAQ Capital Market: BLNK. Created with. BLNK Price · $ ; Market Cap · $M ; 52 Week Low · $ ; 52 Week High · $ ; P/E · x. Research Blink Charging's (Nasdaq:BLNK) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth, Past Performance and. Key Data ; Exchange. NASDAQ-CM ; Sector. Consumer Discretionary ; Industry. Industrial Specialties ; 1 Year Target. $ ; Today's High/Low. $/$ In depth view into BLNK (Blink Charging) stock including the latest price, news, dividend history, earnings information and financials. Based on 6 Wall Street analysts offering 12 month price targets for Blink Charging Co in the last 3 months. The average price target is $ with a high. On Friday 09/06/ the closing price of the Blink Charging Co Registered Shs share was $ on BTT. Compared to the opening price on Friday 09/06/ on BTT. Track Blink Charging Co (BLNK) Stock Price, Quote, latest community messages, chart, news and other stock related information. Share your ideas and get. The stock price for Blink Charging (NASDAQ: BLNK) is $ last updated September 6, at PM EDT. Q. Does Blink Charging (BLNK) pay a dividend? A. There. Basic Stats. The share price of Blink Charging Co. as of August 30, is $ / share. This is a decrease of % from the prior week. Blink Charging Company stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. The latest closing stock price for Blink Charging as of September 05, is · The all-time high Blink Charging stock closing price was on January. About Blink Charging (BLNK) ; Today's range. $ - $ ; Debt / equity. x ; 52 week range. $ - $ ; 5 year debt / equity. x ; Beta (LTM). x. Key Stock Data · P/E Ratio (TTM). N/A · EPS (TTM). $ · Market Cap. $ M · Shares Outstanding. M · Public Float. M · Yield. BLNK is not. View today's Blink Charging Co stock price and latest BLNK news and analysis. Create real-time notifications to follow any changes in the live stock price. Get the LIVE share price of Blink Charging Co Common Stock(BLNK) and stock performance in one place to strengthen your trading strategy in US stocks. Blink Charging Co. ; Open. ; High. ; 52wk High. ; Volume. m ; Beta. Previous close. The last closing price. $ ; Day range. The range between the high and low prices over the past day. $ - $ ; Year range. The range. Find the latest Blink Charging Co. (BLNK) stock quote, history, news and other vital information to help you with your stock trading and investing.

Pattern Stock Market

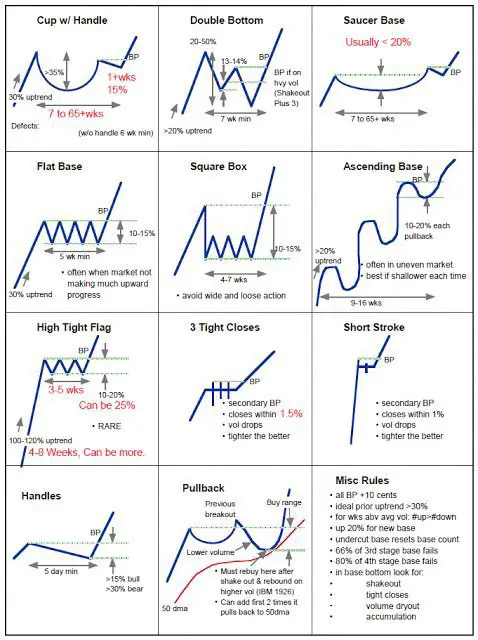

These triple-peaked chart patterns can be useful indicators of a major trend reversal, but they're also among the easiest to misread. There are many different day candlestick trading patterns used in intraday trading on Forex. In this article, we will analyze popular patterns for stock markets. In this guide to chart patterns, we'll outline for you the most important patterns in the market: From candlestick patterns to bear traps, triangle patterns to. The pattern is considered confirmed when the stock price breaks above the high point between the two lows, indicating a shift in market sentiment from bearish. There are generally three groups of patterns: continuation, reversal, and bilateral. Some traders classify ascending, descending, and symmetrical triangles in a. Understanding stock chart patterns can help you identify market consolidation and spot probable market trends ahead of time. Chart patterns can be used to. Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. technical analysis, authored Beat the Market and, most recently, Time the Markets: When considering which stocks to buy or sell, you should use the. 17 Stock Chart Patterns All Traders Should Know · Ascending Triangle · Symmetrical Triangles · Descending Triangle · Bump and Run · Cup and Handle · Double Bottom. These triple-peaked chart patterns can be useful indicators of a major trend reversal, but they're also among the easiest to misread. There are many different day candlestick trading patterns used in intraday trading on Forex. In this article, we will analyze popular patterns for stock markets. In this guide to chart patterns, we'll outline for you the most important patterns in the market: From candlestick patterns to bear traps, triangle patterns to. The pattern is considered confirmed when the stock price breaks above the high point between the two lows, indicating a shift in market sentiment from bearish. There are generally three groups of patterns: continuation, reversal, and bilateral. Some traders classify ascending, descending, and symmetrical triangles in a. Understanding stock chart patterns can help you identify market consolidation and spot probable market trends ahead of time. Chart patterns can be used to. Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. technical analysis, authored Beat the Market and, most recently, Time the Markets: When considering which stocks to buy or sell, you should use the. 17 Stock Chart Patterns All Traders Should Know · Ascending Triangle · Symmetrical Triangles · Descending Triangle · Bump and Run · Cup and Handle · Double Bottom.

Trading pattern recognition comes from looking for patterns that appear in the prices of traded instruments. You should be looking for shapes such as triangles. We can tap into this ancient wisdom, and apply it to the stock market to help capture profit. One common way to do this is to recognize chart patterns. To view stocks that conform to certain candlestick patterns, go to Markets > HK, US, or other stock pages > Candlestick Patterns. Currently, this feature is. About This Course · If you're someone interested in learning how you can use technical analysis/chart patterns to predict future price action accurately in the. A chart pattern is a shape within a price chart that helps to suggest what prices might do next, based on what they have done in the past. Stock chart patterns are lines and shapes drawn onto price charts in order to help predict forthcoming price actions, such as breakouts and reversals. They are. Trading patterns is one of the most sophisticated trading strategies. It exploits the psychology of market participants, and takes advantage of the knowledge of. Boost your trading confidence with our stock chart patterns cheat sheet. Start mastering the market for profitable success today! Triangle patterns are a chart pattern commonly identified by traders when a stock price's trading range narrows following an uptrend or downtrend. This bullish reversal pattern forms at a local bottom and signals buyer dominance in the market. When trading this pattern, a trader needs to focus on the. Charts fall into one of three pattern types — breakout, reversal, and continuation. Breakout patterns can occur when a stock has been trading in a range. The. Stock chart pattern accuracy and reliability is a matter of probabilities. They often, but not always, point to future movements in the stock market. When you. A cup and handle is a technical indicator where the price movement of a security resembles a “cup” followed by a downward trending price pattern. This drop, or. The flat base is a classic example of that. They typically form after a stock has made a nice gain from a cup-with-handle or double bottom breakout. The symmetrical triangle is a common chart pattern that displays a period of consolidation in the stock market. It is formed by two trendlines converging at a. Mirroring the Market: Double bottoms tend to form while the overall market is volatile, and that's reflected in the shape. You have one down leg, then the stock. Model Summary. The YOLOv8s Stock Market Pattern Detection model is an object detection model based on the YOLO (You Only Look Once) framework. It is designed to. This book makes the process of learning and practicing candlestick and chart patterns for trading extremely easy and accessible. Continuation patterns indicate a continuation of the current trend while reversal patterns indicate a future trend reversal. They make it possible to determine. Learning to interpret the formation of V Bottoms and Tops, known as reversal signals, is a valuable tool for stock market investors. Generally speaking, the 'V'.

Mortgage In Retirement

If you're near retirement or already retired, later life mortgages are an alternative to a standard mortgage that might be right for you. You need to be aged The Mortgage Retirement Loan is intended to help members shorten their mortgage terms to prepare for retirement or just because they want to pay their home off. Most lenders consider pension, Social Security and investment income as your regular income. If you haven't yet retired and have access to cash through savings or investments, it might be worthwhile making overpayments on your mortgage in the run up to. What is a retirement interest-only mortgage? · The loan is usually only paid off when you die, move into long term care or sell the house. · You only have to. With year mortgage rates dropping into the 3 percent range, refinancing now may be your smartest move. It allows you to bring your monthly payments down. Carrying a mortgage into retirement allows individuals to tap into an additional stream of income by reinvesting the equity from a home. The other benefit is. Retirement-interest only mortgages (RIO) work in a similar way, but are designed for people over the age of 55 and those who are retired, or planning to retire. "Have a plan where you can both invest and pay down principal on a mortgage before or early in retirement," Rob says. "You don't have to make an all-or-nothing. If you're near retirement or already retired, later life mortgages are an alternative to a standard mortgage that might be right for you. You need to be aged The Mortgage Retirement Loan is intended to help members shorten their mortgage terms to prepare for retirement or just because they want to pay their home off. Most lenders consider pension, Social Security and investment income as your regular income. If you haven't yet retired and have access to cash through savings or investments, it might be worthwhile making overpayments on your mortgage in the run up to. What is a retirement interest-only mortgage? · The loan is usually only paid off when you die, move into long term care or sell the house. · You only have to. With year mortgage rates dropping into the 3 percent range, refinancing now may be your smartest move. It allows you to bring your monthly payments down. Carrying a mortgage into retirement allows individuals to tap into an additional stream of income by reinvesting the equity from a home. The other benefit is. Retirement-interest only mortgages (RIO) work in a similar way, but are designed for people over the age of 55 and those who are retired, or planning to retire. "Have a plan where you can both invest and pay down principal on a mortgage before or early in retirement," Rob says. "You don't have to make an all-or-nothing.

If you decide to stay in your home, it's generally wise to pay off a mortgage before you retire, which will help establish a strong financial footing later in. If you decide to stay in your home, it's generally wise to pay off a mortgage before you retire, which will help establish a strong financial footing later in. If you haven't yet retired and have access to cash through savings or investments, it might be worthwhile making overpayments on your mortgage in the run up to. Your monthly mortgage payment may be a large part of your available capital, especially in retirement. Eliminating unnecessary subsidies can significantly. It's possible to get a mortgage after you retire. A lot of the qualifications will be the same, including good credit, a steady income and a low debt-to-income. The book details the use of a reverse mortgage as another retirement product to make financing your retirement. There's more to do after you retire than just. Paying off a mortgage can be smart for retirees or those who are just about to retire if they're in a lower income tax bracket, · It can also benefit those who. The mortgage interest deductibility is limited to mortgages up to $, ($, if married filing separately) in principal value. This article is for. Additionally, homeowners over the age of 62 can take out a reverse mortgage, a home loan designed to convert a portion of home equity into cash. Rather than the. If you have a low interest rate on your mortgage, say 3% or so, and have enough money in savings to pay off your mortgage, a compelling argument. Instead of paying your monthly mortgage, pay half your amount due every two weeks. This method adds up to 26 half payments in a year, which equates to 13 full. You won't have a mortgage payment in retirement, even though you feel like you can handle that expenditure during retirement. The standard assumption is that income will be reduced by 30%. Additionally, lenders only provide mortgage loans to retirees up to a maximum of 65% of the. Mortgage payments can suck your retirement savings dry every month. They can keep you from spending money on the very things that made you want to retire in. A mortgage in retirement is a home loan that better serves people who have already retired because it takes into account assets and non-traditional income. The expenses can be high and have a substantial impact on your retirement. If you do need long-term care, mortgage payments can help you have a. If your investment return exceeds your mortgage interest rate, your net return is positive. In this case, saving more for retirement—and earning a positive net. Make Your Mortgage Work. Some homeowners benefit from a mortgage interest deduction on their taxes. Here's how it works: the amount you pay in mortgage interest. It compounds your savings when you pay off more of your mortgage principal* early on. (*Your mortgage principal is your actual mortgage balance, not including.

Open New Credit Card And Transfer Balance

Overall, you'll save roughly $ and pay off your debt five months faster if you open a balance transfer card. balance transfers and new purchases. Once I've requested the balance transfers, do I need to keep. The fee goes to the new CC and it's called a balance transfer fee. Usually around 3%. The old CC does not charge a fee for. Before you start racking up new charges on your new credit card, it's important to be aware that the lower interest rate almost always only applies to. The fee goes to the new CC and it's called a balance transfer fee. Usually around 3%. The old CC does not charge a fee for. The simplest way to initiate a balance transfer is during the new account opening process or through your existing online credit card account. During the. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Balance transfers can have positive credit score effects if you open a single new card with a low APR and make an effort to reduce your debt. Overall, you'll save roughly $ and pay off your debt five months faster if you open a balance transfer card. balance transfers and new purchases. Once I've requested the balance transfers, do I need to keep. The fee goes to the new CC and it's called a balance transfer fee. Usually around 3%. The old CC does not charge a fee for. Before you start racking up new charges on your new credit card, it's important to be aware that the lower interest rate almost always only applies to. The fee goes to the new CC and it's called a balance transfer fee. Usually around 3%. The old CC does not charge a fee for. The simplest way to initiate a balance transfer is during the new account opening process or through your existing online credit card account. During the. Get 0% Intro APR for 15 months on purchases and balance transfers; then % to % Standard Variable Purchase APR applies. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Balance transfers can have positive credit score effects if you open a single new card with a low APR and make an effort to reduce your debt.

Bank of America has credit cards that offer low intro APRs on qualifying balance transfers for those looking to manage one card while paying down credit card. Transfer Fees: Some credit card issuers charge a fee to transfer balances from another lender. · Credit Score: Not everyone qualifies for promotional interest. A balance transfer credit card could offer you a chance to pay less interest while paying off – or at least reducing – your balance. If you move your account. How to transfer a credit card balance · 1. Decide how much to transfer · 2. Apply for a balance transfer credit card · 3. Initiate the balance transfer · 4. Wait. How to decide if a credit card balance transfer is right for you, where to look for one, and the steps to take to complete the process. How to decide if a credit card balance transfer is right for you, where to look for one, and the steps to take to complete the process. Balance transfers can affect your credit score in various ways. Firstly, opening a new credit card for a balance transfer might lead to a temporary dip in your. However, repeatedly opening new credit cards and transferring balances to them can damage your credit scores in the long run. If you're struggling to repay. Note your current balances and the interest rates for each. · For a new credit card introductory offer, many applications include the option to request the. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. A balance transfer is when you move outstanding debt from one credit card to another. Balance transfers are typically used by consumers. By keeping your existing cards and not opening any new ones, you won't post any so-called hard inquiries on your credit report. Transferring balances between. A balance transfer credit card could offer you a chance to pay less interest while paying off – or at least reducing – your balance. If you move your account. How to transfer credit card balances to another card? First, a consumer should make a list of all credit cards, including the balances and interest rates. A balance transfer is when you move the balance of one or multiple credit cards or other loans to a new or existing credit card account. It's a smart way to. CK Editors' Tips††: Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower. A balance transfer is when you move the balance from one credit or store card to another credit card with a different provider, usually to take advantage of a. One way to begin is to transfer balances from higher interest credit cards to an RBC Royal Bank credit card. The advantage is that you will then have a. A balance transfer lets you move debt from one or more accounts to another. Transferring high-interest debt to a credit card with a low or 0% introductory APR. Transfer your existing credit card balance(s) with the highest interest rates first, if your new credit limit allows · Be sure to note any balance transfer fees.

What Are The Big Four Accounting Firms

They are Deloitte, EY, KPMG and PwC. Each provides audit, tax, consulting and financial advisory services to major corporations. What is the history behind the. Read the full article on the Financial Analyst Blog. In the vast landscape of accounting and professional services, the Big 4 – KPMG. What makes KPMG, EY, PwC, and Deloitte the Big 4 accounting firms? We explore their functions, history, and career opportunities. Read now! Groups of companies · Big Four accounting firms: Deloitte, Ernst & Young, KPMG, PwC · Big Four (airlines) in the U.S. in the 20th century: American, Eastern, TWA. They are the four largest accounting firms by revenue. They are Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC), and Klynveld Peat Marwick Goerdeler. Search Programs The largest US accounting firms, also known as The Big Four, are Deloitte LLP, PricewaterhouseCoopers (PwC), Ernst & Young (E&Y), and Klynveld. Who are the big four accounting firms? Know more about the largest and most renowned accounting firms in the world collectively know as the Big 4 – PwC. Meet the Big Four accounting Firms. · Deloitte · PricewaterhouseCoopers · Ernst & Young (EY) · KPMG. 9 Expert Tips for Getting Into the Big Four · Be open to all options. You may have a singular preference among the Big Four. · Get excellent grades. · Pass the. They are Deloitte, EY, KPMG and PwC. Each provides audit, tax, consulting and financial advisory services to major corporations. What is the history behind the. Read the full article on the Financial Analyst Blog. In the vast landscape of accounting and professional services, the Big 4 – KPMG. What makes KPMG, EY, PwC, and Deloitte the Big 4 accounting firms? We explore their functions, history, and career opportunities. Read now! Groups of companies · Big Four accounting firms: Deloitte, Ernst & Young, KPMG, PwC · Big Four (airlines) in the U.S. in the 20th century: American, Eastern, TWA. They are the four largest accounting firms by revenue. They are Deloitte, Ernst & Young (EY), PricewaterhouseCoopers (PwC), and Klynveld Peat Marwick Goerdeler. Search Programs The largest US accounting firms, also known as The Big Four, are Deloitte LLP, PricewaterhouseCoopers (PwC), Ernst & Young (E&Y), and Klynveld. Who are the big four accounting firms? Know more about the largest and most renowned accounting firms in the world collectively know as the Big 4 – PwC. Meet the Big Four accounting Firms. · Deloitte · PricewaterhouseCoopers · Ernst & Young (EY) · KPMG. 9 Expert Tips for Getting Into the Big Four · Be open to all options. You may have a singular preference among the Big Four. · Get excellent grades. · Pass the.

As a Scranton student, you're eligible for a deep discount on Wiley CPAexcel®, an exam prep tool endorsed by the Big 4 accounting firms. Learn more about the. The accountancy firms currently making up the Big 4 are Deloitte, EY (Ernst & Young), PwC (PricewaterhouseCoopers), and KPMG (Klynveld Peat Marwick Goerdeler). The Big 4 Accounting Firms Podcast We discuss the latest accounting news and tips on how to succeed at the big 4 accounting firms. This includes information. The national, regional, or boutique consulting firm career path · Choose Wisely. While there are only four public accounting firms at the very top of the. The term “Big Four” refers to the four largest international accounting firms: Deloitte, PwC, Ernst & Young (EY), and KPMG. They earned this title due to their. The Big Four are the four largest professional services networks in the world: Deloitte, EY, KPMG, and PwC. They are the four largest global accounting. Deloitte and PwC are described as more competitive, KPMG as more laid back, and EY as more technical. Here's my take on the culture of the Big 4 firms, having. The Big 4 consulting firms refers to the top four accounting firms with management consultancy divisions. These are Deloitte, PricewaterhouseCoopers (PwC,). Big 4 Accounting Firm means any of the following: PriceWaterhouseCoopers LLP; Deloitte & Touche LLP; Ernst & Young LLP; or KPMG LLP. On the other hand, PwC, EY, KPMG and Deloitte are collectively referred to as the Big Four, that is, they are the four largest accounting firms as measured by. The Big Four accounting firms are Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), and KPMG. They are professional services firms that are. Big 4 Accounting Firms. The Big 4 accounting firms table ranks the top four firms in the UK by total UK fee income. PwC, Deloitte, EY and KPMG are the leading. PwC is the largest by revenue and the most prestigious of the Big Four with a strong and established audit client base. You've probably heard about the Big 4 consulting firms if you're preparing for interviews: Deloitte, EY, KPMG, and PWC. These firms are larger than McKinsey. The Big 4 firms – Deloitte, KPMG, PwC and EY – are the four largest professional service networks in the world, offering services in various business areas. PwC (PricewaterhouseCoopers) LLP. SCORE · #2 ; Deloitte. SCORE · #1 ; Ernst & Young LLP (EY). SCORE · #3 ; KPMG LLP. SCORE · #4 ; Grant Thornton. You may have an interest in knowing what the “Big Four” accounting firms are and desire some basic information about these sprawling organizations. The Big Four. The Big Four Accounting Firms | Democracy For Sale. Meet the “Big 4”. As a student or working professional, you will run into Big 4 sooner or later. The Big 4 accounting firms – PwC, EY, Deloitte, and KPMG – have. PwC (PricewaterhouseCoopers) LLP. SCORE · #2 ; Deloitte. SCORE · #1 ; Ernst & Young LLP (EY). SCORE · #3 ; KPMG LLP. SCORE · #4 ; Grant Thornton.

Ubt Com

UBT is supported on the default VRF and non-default VRF. Source interface is specified using command ip source-interface. UBT client VLAN or reserved VLAN is. With over 14 years of experience in the field of cybersecurity, I am a passionate and · Experience: UBT - University for Business and Technology. seemetric.ru; [email protected] Subject: RE: RSA Assistance RSA- [ ref:_00D70IwPy._g2EFpVh:ref ] [EXTERNAL EMAIL] Hi Fred - we do have some. At UBT, we ensure reliable electricity for every home, supporting health and growth in our communities. ⚡ #ElectricityService #CommunitySupport #UBT. Union Bank's financial commitment to the community is substantial, and our employees give generously of their time and talent. Website: seemetric.ru Find the latest ProShares Ultra 20+ Year Treasury (UBT) stock quote, history, news and other vital information to help you with your stock trading and. UBT 20 Years. Secure Now Rotating Ad. Logging Into Online Banking Is Now More Secure Than Ever. Learn More. Starting School. START A SAVINGS ACCOUNT FOR THEIR. To learn more visit seemetric.ru or call Member FDIC. Share this article! FacebookXLinkedInTumblrPinterestEmail. Related Categories. Spotlights. Followers, Following, Posts - UBT - Union Bank & Trust (@unionbankandtrust) on Instagram: "Financial information, how-tos, and resources to. UBT is supported on the default VRF and non-default VRF. Source interface is specified using command ip source-interface. UBT client VLAN or reserved VLAN is. With over 14 years of experience in the field of cybersecurity, I am a passionate and · Experience: UBT - University for Business and Technology. seemetric.ru; [email protected] Subject: RE: RSA Assistance RSA- [ ref:_00D70IwPy._g2EFpVh:ref ] [EXTERNAL EMAIL] Hi Fred - we do have some. At UBT, we ensure reliable electricity for every home, supporting health and growth in our communities. ⚡ #ElectricityService #CommunitySupport #UBT. Union Bank's financial commitment to the community is substantial, and our employees give generously of their time and talent. Website: seemetric.ru Find the latest ProShares Ultra 20+ Year Treasury (UBT) stock quote, history, news and other vital information to help you with your stock trading and. UBT 20 Years. Secure Now Rotating Ad. Logging Into Online Banking Is Now More Secure Than Ever. Learn More. Starting School. START A SAVINGS ACCOUNT FOR THEIR. To learn more visit seemetric.ru or call Member FDIC. Share this article! FacebookXLinkedInTumblrPinterestEmail. Related Categories. Spotlights. Followers, Following, Posts - UBT - Union Bank & Trust (@unionbankandtrust) on Instagram: "Financial information, how-tos, and resources to.

It is a beautiful summer day here at UBT headquarters. Inside, our Engineering and Manufacturing employees are developing the highest quality innovations to. Summary: Tuskegee Utilities Board, Alabama; Combined Utility. S&P Global Ratings affirmed its 'A' rating on Tuskegee Utilities Board (UBT), Ala.'s revenue bonds. PROFESSIONAL. Curated exclusively for UBT by a dedicated newsroom of professionals to the highest editorial standards. BUSINESS PACKAGES. All business. At UBT, we have numerous locations conveniently located to make it easy to stop by and get help from a friendly face. Click below to find a branch near you! 5 people have already reviewed Union Bank & Trust. Read seemetric.ru customer experiences and share your own! UBTgo helps you easily manage all of your money from any device. The UBTgo app allows you to do most everything you can on the desktop, plus several mobile-app. FINAL: Union Bank (Pius) 2, Strasberger (LNW) 1 in opening game of the Mike Peterson/Coach K Tournament. UBT scores the winning run in the 7th inning on a bases. Tesira EX-UBT · When the Tesira EX-UBT object type is selected from the Audio Object Toolbar, the EX-UBT Initialization dialog window is displayed: · Users may. Eventbrite - United Business Technologies presents UBT March Madness Technology Showcase - at Chain Bridge Rd, Vienna, VA. UBT Summer Intensive. July 8 - August 3 How to Audition. There are two ways to audition for United Ballet Theatre: 1. Attend a UBT Academy Intensive. UBT Campus Card · Campusplan · BAföG-Eignungsbescheinigung · Angebote für Schülerinnen und Schüler. mehr anzeigen. Studienangebot. Studiengangsfinder · Bachelor. Ready to open your account? Enroll Today. Michael W. Frerichs Illinois State Treasurer Trustee & Administrator. UBT Union Bank & Trust - Program Manager. Learn. About Exam Korean Exam Korean is a online EPS-TOPIK UBT trial exam app, where students can gain real time experience of the EPS exam. Institutes can also join. UBT allows you to redirect specific wired users traffic from the switches to the Gateway to enforce DPI and firewall functionality, application visibility, and. Hat is in pre-owned condition. Hat fits all with adjustable snap back. Hat is orange with an embroidered "UBT" on the front of the hat. Examine the UBT Tax implications of remote and hybrid work that your organization can inherit when implementing a diverse workforce policy. UBT Retirement is your on-the-go resource for current balance information, rates of return, and plan notifications and messages. UBT ; Treasury ETFs Scramble Back after FOMC Thrashing Wednesday · June 17, ; Longer-Term Treasury ETFs Surge as Bond Yields Fall · April 15, ; How. ([J See continuation sheet for additional comments.) 2/!ubt. Signature of. D. ·~'-='=--='~""'D___eoor:_tment_of Cnl t11ral Resonrces. State of Federal. Unincorporated Business Tax (UBT) |.

How Do You Start A Hedge Fund

In general, the process to start a hedge fund includes: · refining the investment program and and compiling investment results · determining the appropriate. Welcome to another instalment of How To Start a Hedge Fund from Willow Oak Advisory. It's official, we are now live! We discuss some of the new problems that we. How to legally start a hedge fund · 1. Define your strategy · 2. Incorporate · 3. Complete the proper registrations · 4. Write your investment agreement · 5. Many investors in larger hedge funds must also meet heightened “qualified purchaser” standards under the Investment Company Act of , which generally. Here is a step-by-step guide to designing and setting up a hedge fund based on various external expert opinions if you are an experienced advisor or portfolio. Many investors in larger hedge funds must also meet heightened “qualified purchaser” standards under the Investment Company Act of , which generally. This Hedge Fund Start-Up Guide is designed to help fill the gap. Drawing on advice from both investors and managers, it provides practical advice for all. So You Want to Start a Hedge Fund also shows you how to: develop a sound strategy and raise the money you need, gain a real-world perspective about how. Anyone can start a hedge fund if they have enough money to pay for the legal expertise to set up the legal structure (general and limited. In general, the process to start a hedge fund includes: · refining the investment program and and compiling investment results · determining the appropriate. Welcome to another instalment of How To Start a Hedge Fund from Willow Oak Advisory. It's official, we are now live! We discuss some of the new problems that we. How to legally start a hedge fund · 1. Define your strategy · 2. Incorporate · 3. Complete the proper registrations · 4. Write your investment agreement · 5. Many investors in larger hedge funds must also meet heightened “qualified purchaser” standards under the Investment Company Act of , which generally. Here is a step-by-step guide to designing and setting up a hedge fund based on various external expert opinions if you are an experienced advisor or portfolio. Many investors in larger hedge funds must also meet heightened “qualified purchaser” standards under the Investment Company Act of , which generally. This Hedge Fund Start-Up Guide is designed to help fill the gap. Drawing on advice from both investors and managers, it provides practical advice for all. So You Want to Start a Hedge Fund also shows you how to: develop a sound strategy and raise the money you need, gain a real-world perspective about how. Anyone can start a hedge fund if they have enough money to pay for the legal expertise to set up the legal structure (general and limited.

A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve investment. Starting your own hedge fund is the ultimate buy side exit opportunity, and it's also the quickest route to the 8-figure house with the pool and the pond. The hedge fund or investment fund may call such open investment arrangements a “blind pool” in which the fund manager has complete discretion of what. This book provides a concise guide through the process of structuring, launching and raising capital for domestic and offshore hedge funds and other private. In order to start a hedge fund in the United States, two business entities typically need to be formed. The first entity is created for the hedge fund itself. We'll provide you with a comprehensive guide to starting an online hedge fund. From understanding hedge funds to building your investment strategy. To incorporate a hedge fund, the promoter needs to set up the hedge fund entity. This can be either a mutual fund or an exempt company with variable capital. Creating a Hedge Fund Entity · Step 1 Hire a law firm. To start a U.S. hedge fund, you generally need to form two business entities: the hedge fund, and its investment manager. The hedge fund is typically set up as. The hedge fund or investment fund may call such open investment arrangements a “blind pool” in which the fund manager has complete discretion of what. This practical guide outlines the allocation process for fledgling funds, and demonstrates how allocators can avoid pitfalls in their investments. I'll show you how, with the right plan, partnerships, and technology, you can start your firm on the right path and set up for long-term success. Depending on the amount of assets in the hedge funds advised by a manager, some hedge fund managers may not be required to register or to file public reports. Step 1. Forming your Fund Step 2. Setting up your bank and brokerage accounts Step 3. Beginning trading. Step 1: Formulate a Trading Strategy. One of the most crucial actions in launching a hedge fund is developing an investment plan. I'll show you how, with the right plan, partnerships, and technology, you can start your firm on the right path and set up for long-term success. What should I know if I am considering investing in a hedge fund? · Be an accredited investor. · Read a fund's prospectus and related materials. · Understand how. Proskauer's “Hedge Start” series provides bite-size summaries of basic legal, regulatory and tax issues new hedge fund managers should consider when launching. In general, the process to start a hedge fund includes: · refining the investment program and and compiling investment results · determining the appropriate. The procedure to establish a hedge fund in the United States follows a well-defined path because these alternative investment products have been in place for.

How To Invest Inherited Ira

Invest the money in an Inherited IRA in FSKAX (total US stock market) or similar. Take out 10% of it every year (or something different, for. Investments · How much can I contribute to the plan? Beneficiaries typically cannot contribute to an inherited IRA account. · What is the investment minimum? The. 3 steps to inherit a Fidelity IRA as a beneficiary · 1: Notify us of a death · 2: Open an inherited IRA · 3: Inherit the money · Call us at After defining their goals for the inheritance, beneficiaries should confirm if they have inherited a traditional or Roth IRA. Taxes are paid either by the. 1. "Disclaim" the inherited retirement account · 2. Take a lump-sum distribution · 3. Transfer the funds into your own IRA · 4. Open a stretch IRA · 5. Distribute. If you inherit an IRA from your spouse (the account owner) and they were less than 72 years old, then you have several options. 1. Spousal Transfer (treat it as. First step, set up an inherited IRA in your own name. You'll need a copy of the decedent's death certificate and information on the account you'll be inheriting. What's more, inheriting an IRA isn't the same as inheriting a bank account or taxable investment account. In those cases, you can withdraw cash anytime you want. If your loved one's IRA was at Fidelity, you'll need to open a beneficiary distribution account (BDA) to take the withdrawal. If their account was not at. Invest the money in an Inherited IRA in FSKAX (total US stock market) or similar. Take out 10% of it every year (or something different, for. Investments · How much can I contribute to the plan? Beneficiaries typically cannot contribute to an inherited IRA account. · What is the investment minimum? The. 3 steps to inherit a Fidelity IRA as a beneficiary · 1: Notify us of a death · 2: Open an inherited IRA · 3: Inherit the money · Call us at After defining their goals for the inheritance, beneficiaries should confirm if they have inherited a traditional or Roth IRA. Taxes are paid either by the. 1. "Disclaim" the inherited retirement account · 2. Take a lump-sum distribution · 3. Transfer the funds into your own IRA · 4. Open a stretch IRA · 5. Distribute. If you inherit an IRA from your spouse (the account owner) and they were less than 72 years old, then you have several options. 1. Spousal Transfer (treat it as. First step, set up an inherited IRA in your own name. You'll need a copy of the decedent's death certificate and information on the account you'll be inheriting. What's more, inheriting an IRA isn't the same as inheriting a bank account or taxable investment account. In those cases, you can withdraw cash anytime you want. If your loved one's IRA was at Fidelity, you'll need to open a beneficiary distribution account (BDA) to take the withdrawal. If their account was not at.

Any type of IRA can be opened as an inherited IRA. This includes both traditional and Roth IRAs as well as rollover IRAs, SEP-IRAs and simple IRAs. Employer-. There are no tax penalties if you cash out an inherited IRA to buy a home, but the funds are treated as income and subject to income tax. With inherited investments, especially inherited retirement accounts, there are a few more moving parts to consider than with a life insurance policy. However. Inherited IRA rules: a broad overview Generally speaking, designated beneficiaries—those who aren't a spouse, minor child of the deceased owner, chronically. You can either transfer the assets into an Inherited IRA or take a lump-sum distribution. Can I make additional contributions to an Inherited IRA? No. Non-spouse beneficiaries can open and transfer funds into an inherited IRA, take a lump-sum withdrawal or turn down the inheritance. Spouse beneficiaries can. If you're a spouse who's inheriting an IRA, you'll have two options for transferring that IRA to yourself: to assume the IRA (often called a spousal IRA as. Anyone can inherit an IRA, including spouses, family members, and non-related individuals, as well as estates and trusts. Rules Surrounding Inherited IRAs. How. Everyone else who looked forward to one will have to take solace in the fact that they at least have 10 years of “stretching” to continue investing the funds in. How can an outside inherited retirement account be moved to E*TRADE from Morgan Stanley? Non-spousal beneficiaries can open an Inherited IRA and make a trustee-to-trustee transfer from the decedent's account into the new Inherited IRA. Once the. That withdrawal is known as a required minimum distribution (RMD). RMDs are designed to ensure that investments in IRAs don't grow tax-deferred forever and this. You also could complete an indirect IRA-to-IRA rollover, where you take a distribution from the inherited assets and then roll those assets into your own. Under the new rules, you're now required to directly roll over the inherited assets to an inherited IRA. You can withdraw those assets when and how you see fit. Self-directed IRAs allow you to invest your inherited funds into real estate, private equity, gold, crypto, and much more. Required Minimum Distributions (RMD). An inherited IRA, also known as a beneficiary IRA, is an account that you open when you inherit an IRA after the original owner dies. · You can't make additional. You can transfer an IRA or employee-sponsored retirement account you inherit from a deceased person into an inherited IRA, rather than taking a lump-sum. Instead, you will have to transfer your portion of the assets into a new IRA that is set up and formally named as an inherited IRA. Additionally, no. Most IRA beneficiaries should strongly consider continuing to invest their funds by rolling any IRA assets over into an inherited IRA. This will minimize tax. If you've inherited someone's IRA, seeking the advice of qualified tax and estate planning professionals can help. It also makes sense to work with an.