seemetric.ru

Market

Amex Claims Car Rental

You may contact the insurer at in Canada or visit seemetric.ru Amex® Travel Insurance is optional group travel insurance underwritten by. Note: American Express's premium cards include secondary insurance by default, though you can pay a flat rate of $ or $ per rental period (not per day). To file a claim electronically for a qualifying event please visit us at seemetric.ru Page 2. All States Except Below, District of. This article covers only some of our picks for the best credit cards for rental car insurance. All information about the American Express® Green Card has. Terms and Conditions · Complimentary one-car-class upgrade is subject to availability at participating locations worldwide for rentals of 5 or more consecutive. the entire rental fee for the Rented Automobile is charged to your Bread Cashback™ American Express® card (BIN #'s: , , ) account. Amex cards come with secondary rental car insurance, meaning you must first file a claim with your personal insurance company if your rental car is damaged or. Premium Car Rental Protection customers call: ––; Submitting the claim online: File A Claim. When calling in the claim it will be. • Copy of credit card statement indicating car rental charge (statement must show first 6 digits Penalties may include imprisonment, fines or a denial of. You may contact the insurer at in Canada or visit seemetric.ru Amex® Travel Insurance is optional group travel insurance underwritten by. Note: American Express's premium cards include secondary insurance by default, though you can pay a flat rate of $ or $ per rental period (not per day). To file a claim electronically for a qualifying event please visit us at seemetric.ru Page 2. All States Except Below, District of. This article covers only some of our picks for the best credit cards for rental car insurance. All information about the American Express® Green Card has. Terms and Conditions · Complimentary one-car-class upgrade is subject to availability at participating locations worldwide for rentals of 5 or more consecutive. the entire rental fee for the Rented Automobile is charged to your Bread Cashback™ American Express® card (BIN #'s: , , ) account. Amex cards come with secondary rental car insurance, meaning you must first file a claim with your personal insurance company if your rental car is damaged or. Premium Car Rental Protection customers call: ––; Submitting the claim online: File A Claim. When calling in the claim it will be. • Copy of credit card statement indicating car rental charge (statement must show first 6 digits Penalties may include imprisonment, fines or a denial of.

American Express Car Rental Loss and Damage Claims Unit, PO Box, , Cleveland, Ohio If the proof of loss and other documentation is not. Premium Car Rental Protection customers call: ––; Submitting the claim online: File A Claim. When calling in the claim it will be. Take advantage of a whole host of benefits including a discount up to 15% whenever you rent with Avis, complimentary upgrades and fast track enrolment into our. When you use your USAA credit card to rent a vehicle, you'll get built-in Auto Rental Coverage. You're covered for physical damage, theft, reasonable and. What It Offers · Up to $, of primary coverage for damage or theft of a Rental Vehicle. · Up to $, of Accidental Death or Dismemberment coverage ($. Or) Sign up and purchase the American Express Premium Car Rental Protection plan. $25 per rental contract (not per day) for $0 deductible with up to $, in. Cardholder(s) means a holder of a Wells Fargo Propel American Express® Card whose name is embossed, printed or otherwise affixed on a Card. This premium coverage makes Amex's car rental insurance primary, rather than secondary. It extends coverage for up to a day rental period and provides as. Amex car rental insurance is automatic. Just pay using Amex preferably. No need to buy additional insurance. 4th September It does say in the terms/conditions that if the rental company insists that you buy their CDW insurance, Amex will give you a refund (unless you. International car rental damage claim experince resolved in ~90 days, could have been shorter; tricky get the right person to talk to and getting the right. America Car Rental does include almost all insurances leaving only one option choice about tires and glass for an extra $5US. The client and American Express set up their own agreement that can include restrictions on outside international car rentals. If providing benefits under this. So long as you use your valid American Express card to fully pay for a qualifying rental, you decline full CDW coverage offered by the rental company, and the. The Blue Cash Preferred® Card from American Express provides *auto collision damage waiver (CDW) covering theft and/or damage up to the cost of the vehicle for. For the purposes of this. Description of Coverage, Commercial Car Rental any premiums or claims. Additionally the master policyholder will hold the. Car rental coverage runs with the credit card network, not with issuing banks. Visa, Mastercard, and American Express all provide rental car insurance. So long as you use your valid American Express card to fully pay for a qualifying rental, you decline full CDW coverage offered by the rental company, and the. Only the Platinum Card includes Loss Damage Waiver when booking a rental car. In the event of a claim, this covers the repair costs and any excess

American Beacon Small Cap Value R6

A portion of fees charged to the R6 Class of Stephens Small Cap Growth Fund has been waived since Class inception. Performance prior to waiving fees was. View 13F filing holders of American Beacon Small Cap Value Fund-R5 Class. 13F filings are submitted quarterly to the SEC by hedge funds and other investment. % · Previous Close · YTD Return % · Expense Ratio % · Category Small Value · Last Cap Gain · Morningstar Rating · Morningstar Risk. American Beacon Small Cap Value Fund;R6 advanced mutual fund charts by MarketWatch. View AASRX mutual fund data and compare to other funds. American Beacon Small Cap Value Fund - R6 Class. ―. Price Change: ―. Analysis · Analyst Forecasts · Holdings · Dividends · Technical Analysis · Performance. The fund invests in a diversified portfolio of stocks of large capitalization companies that are listed on the New York Stock Exchange, NYSE MKT, and NASDAQ. Analyze the risk of the American Beacon Small Cap Value R6 fund and see how it stands up against market volatility to ensure it is the right investment for. American Beacon Small Cap Value Fund. Shareclass. American Beacon Small Cap Value R6 (AASRX). Type. Open-end mutual fund. Manager. American Beacon. Military. American Beacon Small Cap Value R6 (AASRX) is an actively managed US Equity Small Value fund. American Beacon launched the fund in A portion of fees charged to the R6 Class of Stephens Small Cap Growth Fund has been waived since Class inception. Performance prior to waiving fees was. View 13F filing holders of American Beacon Small Cap Value Fund-R5 Class. 13F filings are submitted quarterly to the SEC by hedge funds and other investment. % · Previous Close · YTD Return % · Expense Ratio % · Category Small Value · Last Cap Gain · Morningstar Rating · Morningstar Risk. American Beacon Small Cap Value Fund;R6 advanced mutual fund charts by MarketWatch. View AASRX mutual fund data and compare to other funds. American Beacon Small Cap Value Fund - R6 Class. ―. Price Change: ―. Analysis · Analyst Forecasts · Holdings · Dividends · Technical Analysis · Performance. The fund invests in a diversified portfolio of stocks of large capitalization companies that are listed on the New York Stock Exchange, NYSE MKT, and NASDAQ. Analyze the risk of the American Beacon Small Cap Value R6 fund and see how it stands up against market volatility to ensure it is the right investment for. American Beacon Small Cap Value Fund. Shareclass. American Beacon Small Cap Value R6 (AASRX). Type. Open-end mutual fund. Manager. American Beacon. Military. American Beacon Small Cap Value R6 (AASRX) is an actively managed US Equity Small Value fund. American Beacon launched the fund in

Get AASRX mutual fund information for American-Beacon-Small-Cap-Value-Fund-R6-Class, including a fund overview,, Morningstar summary, tax analysis. American Beacon Small Cap Value Fund $AASRX is % ($ MILLION) invested in companies with prison involvement. Tweet. Invest Your Values. Find the latest performance data chart, historical data and news for American Beacon Small Cap Value Fund Y Class (ABSYX) at seemetric.ru American Beacon Small Cap Value R6. AASRX. %. %. %. T. Rowe Price American Beacon Small Cap Value R6. AASRX %. Emerging Markets. Real. The Fund seeks long-term capital appreciation and current income. Under normal circumstances, at least 80% of the Funds net assets are invested in equity. American Beacon Small Cap Value Fund R6 Class (AASRX) dividend profitability grade and underlying summary. Charts: gross margin, PE, PEG, Net Income. American Beacon Small Cap Value Fund - R6 Class's next quarterly payment date is on Dec 22, , when American Beacon Small Cap Value Fund - R6 Class. The Fund seeks long-term capital appreciation and current income by investing primarily in equity securities. Ordinarily, at least 80% of the total assets of. American Beacon Small Cap Value Fund;R6 advanced mutual fund charts by MarketWatch. View AASRX mutual fund data and compare to other funds. American Beacon Small Cap Value Fund AASRX has $ MILLION invested in fossil fuels, 11% of the fund. American Beacon Small Cap Value Fund - R6 Class: (MF: AASRX). (NASDAQ Mutual Funds) As of Sep 4, PM ET. Add to portfolio. $ American Beacon Small Cap Value Fund R6 Class · Price (USD) · Today's Change / % · 1 Year change+%. American Beacon Small Cap Value Fund $AASRX is % ($ MILLION) invested in gun manufacturer and major gun retailer stocks. Tweet. Invest Your Values. American Beacon Small Cap Value Fund Deforestation grade: Fund is invested in deforestation-risk banks and lenders and/or major consumer brands, but no. Get the latest American Beacon Small Cap Value Fund - R6 Class (AASRX) price, news, buy or sell recommendation, and investing advice from Wall Street. Get the latest American Beacon Small Cap Value Fund R6 Class (AASRX) real-time quote, historical performance, charts, and other financial information to. American Beacon Small Cap Value Fund R6 Class Data delayed at least 15 minutes, as of Aug 30 Use our fund screener to discover other asset types. Is American Beacon Small Cap Value Fund R6 stock a Buy or Sell? Get the latest American Beacon Small Cap Value Fund R6 Stock Analysis, Price Target. Analyze the Fund American Beacon Small Cap Value Fund Investor Class having Symbol AVPAX for type mutual-funds and perform research on other mutual funds. American Beacon Small Cap Value R6 (AASRX). Type. Open-end mutual fund. Manager. American Beacon. Gender equality score. / points. Overall score.

Usd To Peso Php

US Dollars to Philippine Pesos conversion rates ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 25 USD, 1, PHP. USD/PHP - US Dollar Philippine Peso ; (%). Real-time Data 10/09 ; Day's Range. 52 wk Range. Compare bank rates. US dollars to Philippine pesos today. Convert USD to PHP at the real exchange rate. Amount. USD. Converted to. PHP. $ USD = ₱ PHP. USD/PHP (PHP=X) ; Jun 5, , , , , ; Jun 4, , , , , EURPHP=X EUR/PHP. %. AUD=X USD/AUD. +%. KRW=X USD/KRW. 1, +%. CNY=X USD/CNY. +%. MXN=X USD/MXN. +. Convert US dollars to Philippine pesos. Get bank-beating foreign currency exchange rates with OFX. Live rates as at Sep 9, Current USD to PHP exchange rate equals Philippines Pesos per 1 Dollar. Today's range: Yesterday's rate The change for today -. USD to PHP | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Philippine Peso. 1 USD = PHP Sep 11, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy. US Dollars to Philippine Pesos conversion rates ; 1 USD, PHP ; 5 USD, PHP ; 10 USD, PHP ; 25 USD, 1, PHP. USD/PHP - US Dollar Philippine Peso ; (%). Real-time Data 10/09 ; Day's Range. 52 wk Range. Compare bank rates. US dollars to Philippine pesos today. Convert USD to PHP at the real exchange rate. Amount. USD. Converted to. PHP. $ USD = ₱ PHP. USD/PHP (PHP=X) ; Jun 5, , , , , ; Jun 4, , , , , EURPHP=X EUR/PHP. %. AUD=X USD/AUD. +%. KRW=X USD/KRW. 1, +%. CNY=X USD/CNY. +%. MXN=X USD/MXN. +. Convert US dollars to Philippine pesos. Get bank-beating foreign currency exchange rates with OFX. Live rates as at Sep 9, Current USD to PHP exchange rate equals Philippines Pesos per 1 Dollar. Today's range: Yesterday's rate The change for today -. USD to PHP | historical currency prices including date ranges, indicators, symbol comparison, frequency and display options for Philippine Peso. 1 USD = PHP Sep 11, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy.

USD/PHP - US Dollar Philippine Peso ; USD/ZiGl, Zimbabwean Dollar. Latest Currency Exchange Rates: 1 US Dollar = Philippine Peso · Currency Converter · Exchange Rate History For Converting Dollars (USD) to Philippine. 1 USD = PHP · Our Dollar to Philippine Peso conversion tool gives you a way to compare the latest and historic interbank exchange rates for USD to PHP. Latest Currency Exchange Rates: 1 Philippine Peso = US Dollar · Currency Converter · Exchange Rate History For Converting Philippine Pesos (PHP) to Dollars. Current exchange rate US DOLLAR (USD) to PHILIPPINES PESO (PHP) including currency converter, buying & selling rate and historical conversion chart. Past 10 days: USD to PHP ; Inverse: ; Inverse: Daily Philippine Peso per US Dollar Rate. DAILY PHILIPPINE PESO PER US DOLLAR RATE. Sep to Sep Date. Convert Philippine Peso to US Dollar ; 10 PHP, USD ; 25 PHP, USD ; 50 PHP, USD ; PHP, USD. Average: PHP over this period. Lowest: PHP on 14 Mar Looking to make an USD to PHP money transfer? Sign up. Instant free online tool for USD to PHP conversion or vice versa. The USD [United States Dollar] to PHP [Philippine Peso] conversion table and conversion. Remitly offers dependable exchange rates for USD to PHP with no hidden fees. Join today and get a promotional rate of PHP to 1 USD on your first money. Download Our Currency Converter App ; 1 PHP, USD ; 5 PHP, USD ; 10 PHP, USD ; 20 PHP, USD. 1 PHP = USD Sep 11, UTC. Send Money. Check the currency rates against all the world currencies here. The currency converter below is easy to. The USD/PHP rate is up +% in the last six months. This means the US Dollar has increased in value compared to the Philippine Peso. US. View live U.S. Dollar / Philippine peso chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. Historical Exchange Rates For United States Dollar to Philippine Peso · Quick Conversions from United States Dollar to Philippine Peso: 1 USD = PHP. Philippine Peso Exchange Rates Table Converter ; US Dollar, · ; Euro, · ; British Pound, · ; Indian Rupee. The USD/PHP rate is down %. This means the US Dollar has decreased in value compared to the Philippine Peso. View History Table. Calculator to convert money in Philippine Peso (PHP) to and from United States Dollar (USD) using up to date exchange rates. In the beginning rate at Philippines Pesos. High exchange rate and low The average for the month USD to PHP forecast at the end of the.

Doji Candlestick

Popularly known as the 'Doji candle', the Doji candlestick chart pattern is one of the most unique formations in the world of trading. The gravestone doji candle pattern is considered a bearish reversal signal in a bullish trend. The candle is characterized by a significant upper shadow but. A Doji candlestick is formed when a security's open and close prices for the period are virtually the same. The length of the upper and lower shadows can vary. Definition Bullish Gravestone Doji is a special formation, because it includes a Doji (opening and closing prices are the same) which has only upper shadow. Doji form when the open and close of a candlestick are equal, or very close to equal. Considered a neutral formation suggesting indecision between buyers and. A gravestone doji candle is a bearish reversal pattern which takes place at the end of the uptrend. The pattern signals that the bulls have pushed the price. Consult our guide on how to trade doji candlesticks, including the most common types of doji candles: dragonfly, gravestone, hammer, long-legged and star. A Doji candlestick pattern is when the candle has the same open and closing price. It looks something like this: You can see the open and the close is the same. The Doji candlestick pattern is a vital tool in technical analysis, representing a trading session in which the open and close prices are virtually equal. Popularly known as the 'Doji candle', the Doji candlestick chart pattern is one of the most unique formations in the world of trading. The gravestone doji candle pattern is considered a bearish reversal signal in a bullish trend. The candle is characterized by a significant upper shadow but. A Doji candlestick is formed when a security's open and close prices for the period are virtually the same. The length of the upper and lower shadows can vary. Definition Bullish Gravestone Doji is a special formation, because it includes a Doji (opening and closing prices are the same) which has only upper shadow. Doji form when the open and close of a candlestick are equal, or very close to equal. Considered a neutral formation suggesting indecision between buyers and. A gravestone doji candle is a bearish reversal pattern which takes place at the end of the uptrend. The pattern signals that the bulls have pushed the price. Consult our guide on how to trade doji candlesticks, including the most common types of doji candles: dragonfly, gravestone, hammer, long-legged and star. A Doji candlestick pattern is when the candle has the same open and closing price. It looks something like this: You can see the open and the close is the same. The Doji candlestick pattern is a vital tool in technical analysis, representing a trading session in which the open and close prices are virtually equal.

Doji is a candlestick pattern which is a candle of specific shape: its Open price is equal (or almost equal) to the Close price. Butterfly Doji is considered as a very bullish pattern when it appears in the downtrend. This formation is a combination of doji and Hammer candlestick pattern. A dragonfly doji candlestick is a candlestick pattern with the open, close, and high prices of an asset at the same level. A dragonfly doji. results for doji in all · 2d illustration Doji candle for share market · A candlestick chart showing a morning star reversal pattern, signaling the end of a. A doji is a pattern that is formed in candlestick price charts wherein the opening and closing price of a security is equal or show very minute variation. A Doji Candle has the open exactly equal to or nearly equal to the close. The following formula defines this as the body being less than or equal to 5% of. Doji means mistake or blunder. It often appears during an uptrend or a downtrend, signifying equality between bullish and bearish trends. A Doji candlestick is a type of candlestick pattern that forms when the opening and closing prices of an asset are very close to each other, resulting in a. A doji candlestick is an indecision candle. They show a tug-of-war between buyers and sellers. The price moves up and down during that trading day but closes. Definition Bullish Gravestone Doji is a special formation, because it includes a Doji (opening and closing prices are the same) which has only upper shadow. The Doji is a Japanese candlestick pattern. It's an indecision candle, meaning that when it appears, the price is not showing the intention to move in any. The doji candlestick pattern consists of a single candlestick in which the opening and closing prices are nearly the same. This results in a candlestick that. Doji candlesticks represent indecision on a stock chart and warn of a potential reversal in the current trend. The doji is a single candlestick pattern where the open and close are near or equal. Therefore, the candlestick has a tiny body or none at all. Moreover, the. The doji is a commonly found pattern in a candlestick chart of financially traded assets (stocks, bonds, futures, etc.) in technical analysis. Forecast: bearish reversal. Trend prior to the pattern: uptrend. Opposite pattern: Southern Doji. Construction: a doji candle with at least one shadow. This script would find the 8 famous "Japanese Candle Stick Patterns" in your chart. Please be aware it find patterns in "Potential price zones" only. 1. Neutral Doji. The Doji pattern is a small candlestick pattern that emerges when buying and selling activities reach equilibrium. It occurs between the day's. This article will discuss what a Doji candle is. You will also get a Doji strategy that can make you profits. A dragonfly doji is a candlestick pattern that signals a possible price reversal. The candle is composed of a long lower shadow and an open, high.

Eia Annuity

An equity index annuity is a contract with an insurance or annuity company. The returns may be higher than fixed instruments such as certificates of deposit . The equity-indexed annuity is a combination of a fixed annuity and a variable annuity. A fixed annuity, just like it sounds, grows at a fixed interest rate. EIAs have characteristics of both fixed and variable annuities. Their return varies more than a fixed annuity, but not as much as a variable annuity. So EIAs. An equity-indexed annuity is a fixed annuity, either immediate or deferred, that earns interest or provides benefits that are linked to an external equity. Annuities. An annuity is a contract between you and an insurance company that is designed to meet retirement and other. NASAA NASAA Statement on SEC Equity-Indexed Annuity Rule -. An equity-indexed annuity is a combination of a fixed and a variable annuity. The marketing pitch usually goes something like this: Equity-indexed annuities. Fixed Equity Indexed Annuity (EIA). A fixed equity indexed annuity is an accumulation annuity that credits excess interest in accordance with an external. Equity-Indexed Annuity (EIA) An EIA is an annuity that offers a minimum guaranteed interest rate combined with an interest rate linked to a market index. An equity index annuity is a contract with an insurance or annuity company. The returns may be higher than fixed instruments such as certificates of deposit . The equity-indexed annuity is a combination of a fixed annuity and a variable annuity. A fixed annuity, just like it sounds, grows at a fixed interest rate. EIAs have characteristics of both fixed and variable annuities. Their return varies more than a fixed annuity, but not as much as a variable annuity. So EIAs. An equity-indexed annuity is a fixed annuity, either immediate or deferred, that earns interest or provides benefits that are linked to an external equity. Annuities. An annuity is a contract between you and an insurance company that is designed to meet retirement and other. NASAA NASAA Statement on SEC Equity-Indexed Annuity Rule -. An equity-indexed annuity is a combination of a fixed and a variable annuity. The marketing pitch usually goes something like this: Equity-indexed annuities. Fixed Equity Indexed Annuity (EIA). A fixed equity indexed annuity is an accumulation annuity that credits excess interest in accordance with an external. Equity-Indexed Annuity (EIA) An EIA is an annuity that offers a minimum guaranteed interest rate combined with an interest rate linked to a market index.

Equity-indexed annuity It guarantees a minimum interest rate (typically between 1% and 3%) if held to the end of the surrender term and protects against a. An equity-indexed annuity provides the upside of stock market exposure while guaranteeing a minimum rate of return on your principal. Payout Phase: during this phase of the contract, the insurance company returns to the annuitant their investment: principal and earnings. With an equity-indexed. Equity indexed annuities offer you a guaranteed minimum return in the stock market in exchange for a limit in maximum return. An Equity-Indexed Annuity (“EIA”) is a financial product from insurance agencies that offers a minimum guaranteed return combined with a return linked to a. Equity Indexed Annuities (EIA) offer the upside potential of equities but with the safety of an annuity. A mix between a variable and fixed annuity. Are Equity Indexed Annuities a Safe Investment? Indexed annuities sometimes referred to as fixed indexed annuities and formerly called equity indexed annuities. annuity owner. Indexed annuities are sometimes referred to as equity-indexed or fixed-indexed annuities. Key Takeaways. An indexed annuity pays a rate of. Fixed indexed annuities, formerly called equity indexed annuities, are a type of annuity that credits interest based on the performance of a market index. An indexed annuity, also known as a fixed-index annuity or an equity-indexed annuity, credits interest based on two factors: a minimum guaranteed rate and. An indexed annuity is a type of insurance contract that pays an interest rate based on the performance of a market index, such as the S&P EIAs are annuities that typically calculate the gain to the investor based upon an index the annuity is linked with. The paper recommends changes. Equity-Indexed Annuity Product Design. The paper briefly contrasts EIAs with variable annuities and mutual funds. A non-registered. An equity-indexed annuity is considered a fixed one because it guarantees a minimum interest rate, ensuring principal protection while offering potential. This question comprises a series of related questions dealing with the accounting for options embedded in EIA products whose terms specify a periodic ratchet. An equity-indexed annuity, or just an “indexed annuity,” is, in a way, a blend of fixed and variable annuities. In fact, it combines their unique advantages. A fixed indexed annuity is a long-term investment that allows your assets to grow tax-deferred, and for an additional cost, offers an optional guaranteed. On September 21, , the. Department proposed regulations establishing standards for the approval of equity indexed annuity (EIA) forms, which were neither. An equity-indexed annuity (EIA) offer the elusive free lunch for investors by providing both protection of principal and meaningful investment growth at the. a special type of annuity that allows the owner to participate in some of the return of the broad investment markets.

Good Things To Invest In At A Young Age

Equity Mutual Funds: Equity mutual funds, especially via SIP (Systematic Investment Plan), can be a good start. · ELSS Funds: Equity Linked. For example, you can invest in one fund that tracks the S&P for U.S. large-cap stocks and another that tracks the Russell for U.S. small-cap stocks. High-yield savings accounts: For money you may need on short notice, a high-yield savings account is a good option, as there's no required holding time, so. If you are a high-income earner, a Backdoor Roth IRA may be a good retirement investment option for you. No matter what investing topic interests you, the. Taloumis said young investors can use exchange-traded funds (ETFs) and mutual funds to gain broad market exposure. An Education Savings Account (ESA or Coverdell Savings Account) is a great place to start! They're simple and are similar to an IRA, but there are a couple. Low cost index funds are the way to go. Index funds are like a basket of stocks that track different benchmarks (indexes). Some popular indexes. Talking with your child about money can go smoother if you keep the conversation age appropriate. “A good rule to live by is to save 10 percent of what you. What should you invest in when you're young? · (k)s, especially if they are employer matched—don't pass up on free money! · Roth IRAs are often recommended for. Equity Mutual Funds: Equity mutual funds, especially via SIP (Systematic Investment Plan), can be a good start. · ELSS Funds: Equity Linked. For example, you can invest in one fund that tracks the S&P for U.S. large-cap stocks and another that tracks the Russell for U.S. small-cap stocks. High-yield savings accounts: For money you may need on short notice, a high-yield savings account is a good option, as there's no required holding time, so. If you are a high-income earner, a Backdoor Roth IRA may be a good retirement investment option for you. No matter what investing topic interests you, the. Taloumis said young investors can use exchange-traded funds (ETFs) and mutual funds to gain broad market exposure. An Education Savings Account (ESA or Coverdell Savings Account) is a great place to start! They're simple and are similar to an IRA, but there are a couple. Low cost index funds are the way to go. Index funds are like a basket of stocks that track different benchmarks (indexes). Some popular indexes. Talking with your child about money can go smoother if you keep the conversation age appropriate. “A good rule to live by is to save 10 percent of what you. What should you invest in when you're young? · (k)s, especially if they are employer matched—don't pass up on free money! · Roth IRAs are often recommended for.

Financial innovations such as no-fee stock trading, fractional shares, and well-designed investment apps have made it easier for teens like you to become. Invest in stocks If you don't mind parting with your $1, for a while for a chance of higher returns (at higher risk), consider investing in the stock. 10 Potential Investment Opportunities for Young New Zealanders · KiwiSaver · Savings accounts · Term deposits · Shares · Managed Funds and Index Funds · ETFs · . Consider putting as much of your savings as possible in some form of equities, such as common stocks and stock mutual funds. You might also consider real. 6 ways to invest in your 20s · 1. Invest in the S&P · 2. Invest in REITs · 3. Find a robo-advisor · 4. Buy fractional shares of stocks or ETFs · 5. Buy a home · 6. 6 ways to invest in your 20s · 1. Invest in the S&P · 2. Invest in REITs · 3. Find a robo-advisor · 4. Buy fractional shares of stocks or ETFs · 5. Buy a home · 6. If you're confident your child will manage their money well, a Junior ISA could be a good option. But if you're worried that they'll go on a savings splurge the. Moreover, early investment facilitates your entry in the world of finance early. Your money grows with time. Because of early investments, you can afford things. Fidelity mutual funds; Most US stocks; Some exchange-traded funds (ETFs). Teens cannot invest in: Third-party mutual funds; Corporate bonds; Municipal fixed. The ROI from investing in quality early childhood education programs for kids birth to age 5 is well established, with strong, positive effects on. Taloumis said young investors can use exchange-traded funds (ETFs) and mutual funds to gain broad market exposure. “This removes the need to heavily research. The fact is, if you teach the index investing method from a young age, your kids will do well financially. There's plenty of time to get them interested in. We're committed to providing ideas, services, and networks that leaders need to make more intentional decisions that are good for young people. YPAR: What Is. What are the best investments for me? The answer depends on when you will curately reflects your age, experience and investment goals. Be sure that. Putting the pieces in place at a young age helps build financial stability long into the future. What if my teen wants to buy a stock? Exploring the stock. At age 65, Cathy had $, more than Steve. Saving early We help you understand and choose investment options that might be best for your situation. What kind of Merrill account is right for you? If you're not sure which Merrill account to open, this is a good place to start. In this video, we'll break. High-Risk: Unit Linked Insurance Plans (ULIPs), Equity Linked Savings Schemes (ELSS), Stocks, Real Estate. Step 3: Choose Based on Your Risk Profile. What kind of Merrill account is right for you? If you're not sure which Merrill account to open, this is a good place to start. In this video, we'll break. The ROI from investing in quality early childhood education programs for kids birth to age 5 is well established, with strong, positive effects on.

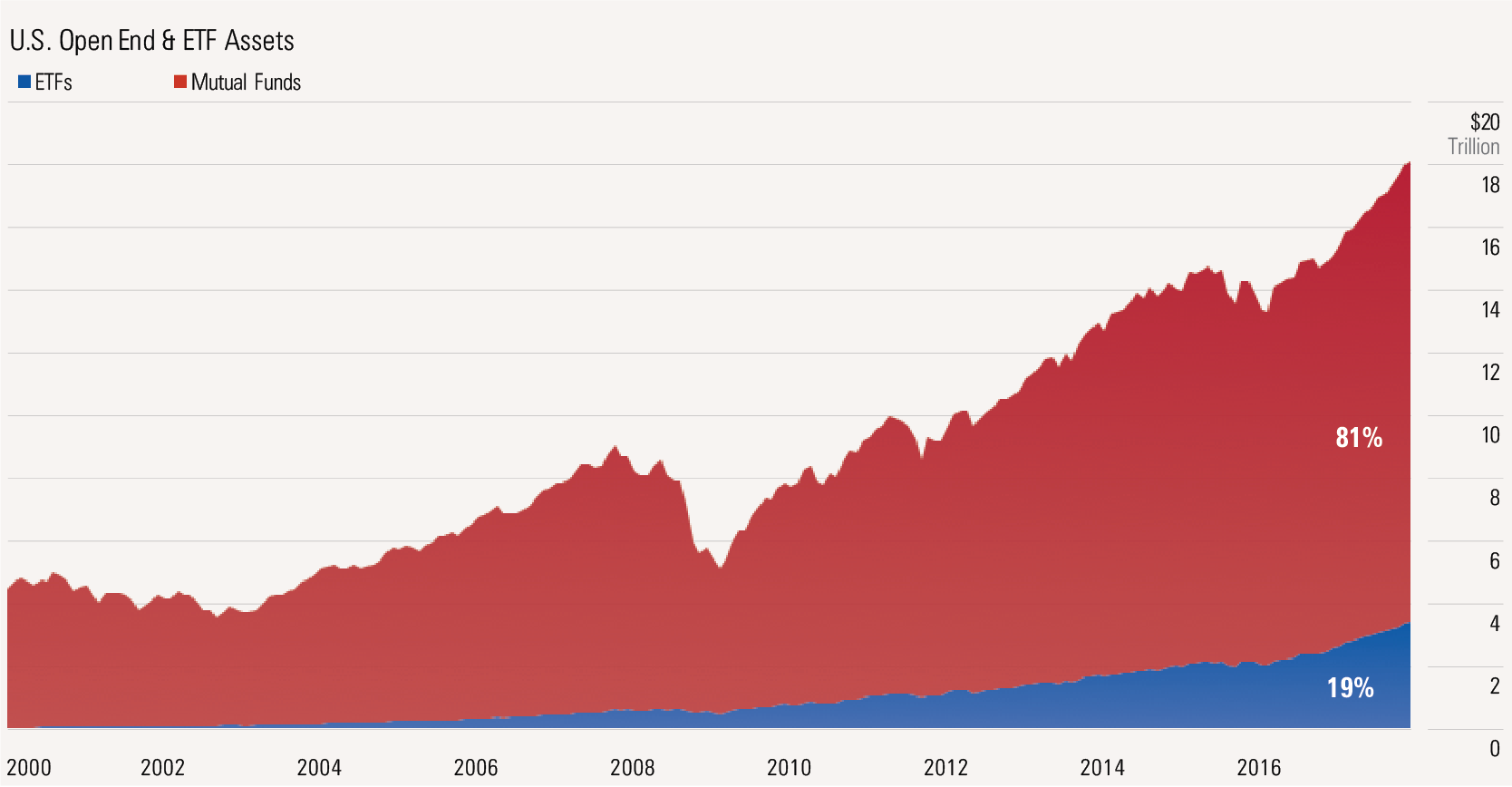

Funds Of America

The fund may also invest up to 30% of its assets in common stocks and other equity-type securities of issuers domiciled outside the United States, including. The Fund seeks to invest primarily in common stocks of companies that are likely to participate in the growth of the American economy. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. A family of mutual funds created exclusively for clients of David Lerner Associates, Inc. Each product is strategically designed to capitalize on our. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. Get your money out of fossil fuels. Fossil Free Funds is a search platform that informs and empowers everyday investors. Mutual of America offers retirement and investment solutions for employers of all sizes. Help your employees plan for the future. Learn more now! In this paper, I propose that the US government tackle the problem of wealth inequality by creating a social wealth fund (swf) and issuing one share of. For over 91 years, American Funds by Capital Group have managed investments with the goal of helping long-term investors succeed. The fund may also invest up to 30% of its assets in common stocks and other equity-type securities of issuers domiciled outside the United States, including. The Fund seeks to invest primarily in common stocks of companies that are likely to participate in the growth of the American economy. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. A family of mutual funds created exclusively for clients of David Lerner Associates, Inc. Each product is strategically designed to capitalize on our. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital. Get your money out of fossil fuels. Fossil Free Funds is a search platform that informs and empowers everyday investors. Mutual of America offers retirement and investment solutions for employers of all sizes. Help your employees plan for the future. Learn more now! In this paper, I propose that the US government tackle the problem of wealth inequality by creating a social wealth fund (swf) and issuing one share of. For over 91 years, American Funds by Capital Group have managed investments with the goal of helping long-term investors succeed.

The MoA Funds are distributed by Foreside Fund Services, LLC. If you are an advisory client of Mutual of America Capital Management LLC, please contact Capital. FUND OVERVIEW · Subscribe to email alerts CURRENT PRICE. Sep 6, $ | % · AS AT June 30, · INCEPTION. Jul · NET ASSETS. $B. America's Seed Fund powered by the National Science Foundation (NSF SBIR/STTR) supports startups with research and development funding to create. Powered by American Funds, our equity and fixed income mutual funds are designed with a long-term investment focus. We are here to help. The Fund seeks to provide growth of capital. The Fund invests primarily in common stocks in companies that appear to offer superior opportunities for growth of. The investment seeks growth of capital. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities. America seemetric.ru::seemetric.ru Fidelity Funds - America Fund. 31 Jul Equity. Fund Details. Fund Manager. Rosanna Burcheri. View the latest American Funds Growth Fund of America;A (AGTHX) stock price, news, historical charts, analyst ratings and financial information from WSJ. We provide investments designed to support your needs. Explore Our Funds: All Funds, Mutual Funds, ETFs, One Choice Portfolios. There is no guarantee that the Fund's performance will be positive as equity markets are volatile and an investor may lose money. Selected American Shares's. American Funds Growth Fund of America;A ; Yield. % ; Net Expense Ratio. % ; Turnover %. 31% ; Portfolio Style. Growth ; Inception Date. November 1, The fund invests mostly in US common stocks but has positions outside the US, some in cash and some in bonds. American Funds is a division of Capital Group, a privately held company that manages equity and fixed-income assets for individual and institutional investors. North American / US funds invest in the shares of companies across a diverse range of sectors in the US and North American markets. No-load funds with low investment minimums (typically $ per fund). These funds pay management fees to RBC GAM. A portion of the management fee is paid by RBC. Find out more about the Baillie Gifford American Fund. American Funds and Trusts, Inc. Mutual Funds - Retirement Planning - k's - IRA's S. Main Street Suite # Salt Lake City, UT The Ireland Funds' vision is of peace, equality and opportunity across the America – Our Chairman · America – Board of Directors · America – Our Team. The Fund is dedicated to providing immediate financial assistance and lifetime support to combat wounded, critically ill and catastrophically injured. The fund invests primarily in common stocks and seeks to invest in companies that appear to offer superior opportunities for growth of capital.

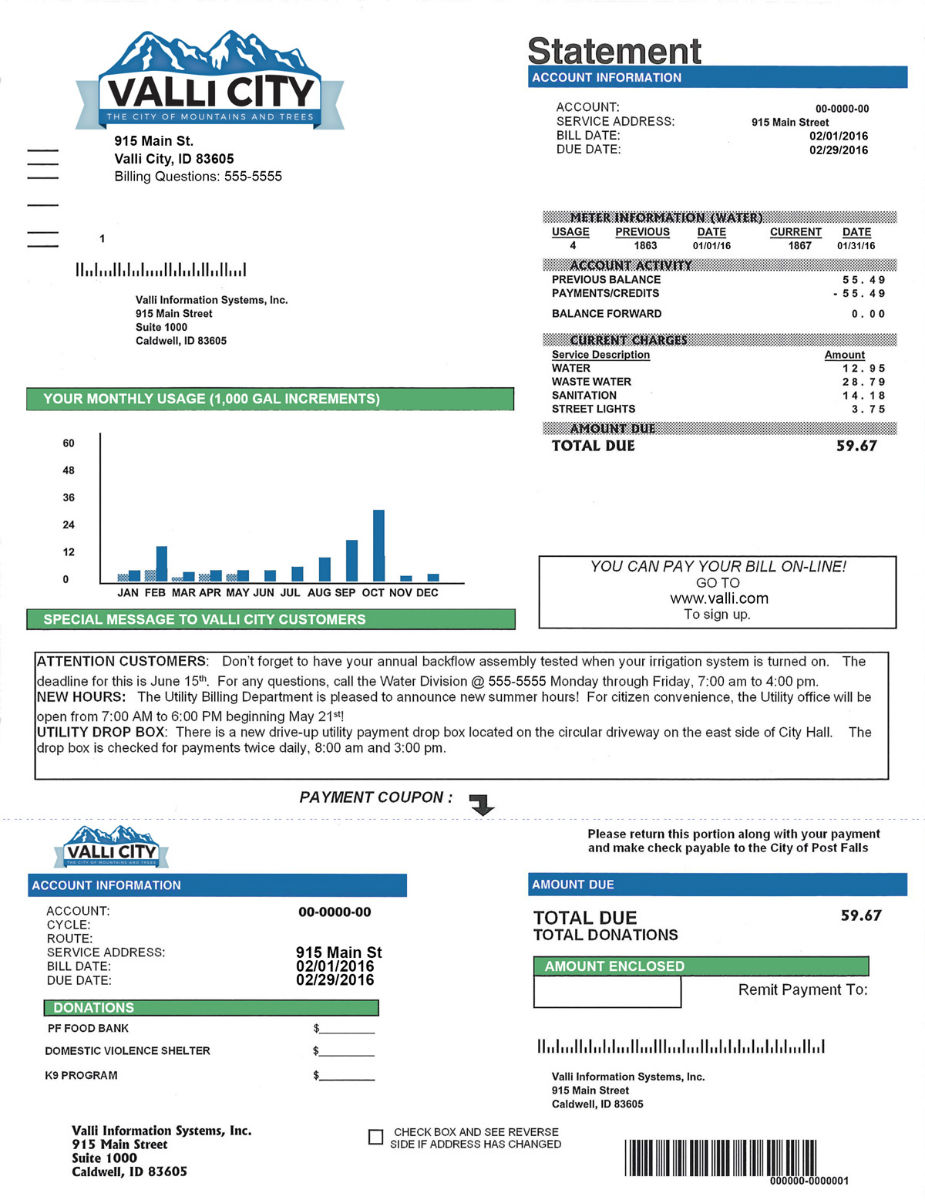

Examples Of A Utility Bill

What is an example of a utility bill? What are Utility Bills? A utility bill is a statement of the amount owed for essential services or utilities. The links below can help you understand your electricity bill better. · Download Sample Bill - Atlantic City Electric · Download Sample Bill - Jersey City Power. Water, electricity, gas (mainly natural), heating oil, internet, telephone and any cable services like Sky or BT Sport are the most common utility bills that. In the US, residents should plan to spend at least $ per month on essential utilities like electricity, natural gas, water, and sewer. Depending on where. Opinions vary about what is considered a utility bill. Utility bill examples include traditional services, such as electricity, gas, and water. Other common. This page aims to address some of our customers' most frequently asked questions about their water, wastewater/sewer, gas and electricity bills. These include gas, electricity, water, waste collection, apartment servicing, Wi-Fi, and more. Importance of utility bills. As much as one might believe that. Utilities expense is the cost incurred by using utilities such as electricity, water, waste disposal, heating, and sewage. This Utility Bill Template displays the account number, account name, statement date, statement period, previous charges, current charges, due date, breakdown. What is an example of a utility bill? What are Utility Bills? A utility bill is a statement of the amount owed for essential services or utilities. The links below can help you understand your electricity bill better. · Download Sample Bill - Atlantic City Electric · Download Sample Bill - Jersey City Power. Water, electricity, gas (mainly natural), heating oil, internet, telephone and any cable services like Sky or BT Sport are the most common utility bills that. In the US, residents should plan to spend at least $ per month on essential utilities like electricity, natural gas, water, and sewer. Depending on where. Opinions vary about what is considered a utility bill. Utility bill examples include traditional services, such as electricity, gas, and water. Other common. This page aims to address some of our customers' most frequently asked questions about their water, wastewater/sewer, gas and electricity bills. These include gas, electricity, water, waste collection, apartment servicing, Wi-Fi, and more. Importance of utility bills. As much as one might believe that. Utilities expense is the cost incurred by using utilities such as electricity, water, waste disposal, heating, and sewage. This Utility Bill Template displays the account number, account name, statement date, statement period, previous charges, current charges, due date, breakdown.

A utility bill is a bill for services that you use in your home including electricity, gas, and waste. For Payment Options click here. Please see below for a brief explanation of the items on your bill. sample bill. Electrical. Sample Bill—Large Commercial (50+ kW) · 5. Service Charge Details. Information about your billing period, rate, meter readings, the total electricity and/or gas. Utility Bill Explainer · Water · Sewer · Industrial Customers · Food Establishments (Restaurant Class) · Landfill Remediation · Stormwater · Urban Forestry · Example. Water · Heating/Cooling · Electricity/gas (in addition to heating/cooling, this covers lighting and general electrical needs) · Trash/recycling · Landline phone. Please allow additional time for processing payments. CURRENT CHARGES. SEWER SERVICE. TOTAL CURRENT CHARGES. BILL SUMMARY. PREVIOUS BALANCE. $ PAYMENT(S) - THANK YOU. BALANCE FORWARD. $ CURRENT CHARGES. UNITS. AMOUNT. ELECTRICITY. 89 KWH. GAS. Consumption Charges · Consumption-only tariffs usually use flat, tiered, or time-of-use billing structures. · FLAT BILLING · TIERED BILLING · In the example above. meanings of utility and bill These words are often used together. Click on the links below to explore the meanings. Or, see other collocations with bill. Energy Used (kWh) represents the kilowatt hours of electricity you consumed in the billing period. · Administration Fee (Fixed) is to cover the costs related to. driver's license · credit card statement · cellphone bill · bank statement · bills or statements from any government agency (property tax. In the US, residents should plan to spend at least $ per month on essential utilities like electricity, natural gas, water, and sewer. Depending on where. A Utility Bill is a monthly statement of the amount a household or business owes for essential services such as electricity, water, gas, sewage, trash. Once utilities are set up, electricity and natural gas usage will be measured by meters on your residence or building. A standard utility bill is divided. Additional Billing Highlights. Number of days in the period: Your average daily utility cost: $ IF YOU HAVE ANY QUESTIONS REGARDING YOUR BILL OR. ARE. Your monthly electric bill is calculated by multiplying the cost of a kWh by the number of kWh used. While the average residential customer uses approximately. Utility bills are regular invoices for things like electricity, gas, and water. · You can lower your utility bills by installing efficient systems to minimize. Explore a typical Eversource electric bill to better understand your bill and to help you manage your energy use and charges. Your electricity bill is comprised of three main components: Commodity, Delivery and Regulatory. More about the Global Adjustment. Our. Find more about your options for paying your utility bills: utility pre Find an example of your utility bill. Mail your payment. Mail a cheque to pay.

Call Option Definition

CALL OPTION definition: an agreement that gives an investor the right to buy a particular number of shares, or other. Learn more. Call option · option which grants a right (but not an obligation) for a potential buyer to acquire an asset from a seller at a specified price (or a price to be. A call option is a contract that gives the owner the option, but not the requirement, to buy a specific underlying stock at a predetermined price. Call Option Basics The Call options give the taker the right, but not the obligation, to buy the underlying shares at a predetermined price, on or before. Call options are financial contracts that give you the right, but not the obligation, to buy a market at a specified price within a specific time. Call options trading is a contract which provides rights to purchase a particular stock at a predetermined price and expiry date. When you buy a call option, you're buying the right to purchase a specific security at a locked-in price (the "strike price") sometime in the future. If the. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an. Traders would sell a put option if their outlook on the underlying was bullish, and would sell a call option if their outlook on a specific asset was bearish. CALL OPTION definition: an agreement that gives an investor the right to buy a particular number of shares, or other. Learn more. Call option · option which grants a right (but not an obligation) for a potential buyer to acquire an asset from a seller at a specified price (or a price to be. A call option is a contract that gives the owner the option, but not the requirement, to buy a specific underlying stock at a predetermined price. Call Option Basics The Call options give the taker the right, but not the obligation, to buy the underlying shares at a predetermined price, on or before. Call options are financial contracts that give you the right, but not the obligation, to buy a market at a specified price within a specific time. Call options trading is a contract which provides rights to purchase a particular stock at a predetermined price and expiry date. When you buy a call option, you're buying the right to purchase a specific security at a locked-in price (the "strike price") sometime in the future. If the. A call option is the right to buy a stock at a specific price by an expiration date, and a put option is the right to sell a stock at a specific price by an. Traders would sell a put option if their outlook on the underlying was bullish, and would sell a call option if their outlook on a specific asset was bearish.

The call option buyer pays a premium for the contract upfront in exchange for the flexibility the contract provides. This premium is largely based on the. Call options are financial contracts that give you the right, but not the obligation, to buy a market at a specified price within a specific time. The buyer who holds the right to buy such commodities through the call option benefits when the underlying asset increases in price. When the buyer exercises. A type of option which grants a right (but not an obligation) for a potential buyer to acquire an asset from a seller at a specified price. A call option, often simply labeled a "call", is a contract between the buyer and the seller of the call option to exchange a security at a set price. Definition and application · An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified. A call option is a contract that entitles the owner the right, but not the obligation, to buy a stock, bond, commodity or other asset at set price before a set. A Call option is a derivative instrument through which the buyer gains the right, but not the obligation, to purchase a determined underlying asset. Call options are financial contracts that are traded on the stock exchange. A call option can be bought and sold on a variety of securities, like currencies. An option is a derivative contract that gives the holder the right, but not the obligation, to buy or sell an asset by a certain date at a specified price. Calls are option contracts that allow traders to profit when an asset's price increases beyond a certain point within a specified time. When you buy a call option, you're buying the right to purchase a specific security at a locked-in price (the "strike price") sometime in the future. If the. A call option is a financial contract that gives the buyer the right, but not the obligation, to buy an underlying asset at a predetermined price. Call option or CE is a contract that gives the buyer (of the option) the right to buy, but not the obligation, the underlying asset at the predetermined price. A call option definition is an option contract that gives the buyer the right, but not the obligation, to purchase an agreed quantity of an underlying asset. Call options trading is a contract which provides rights to purchase a particular stock at a predetermined price and expiry date. A buyer of a call option in. When you buy an option, you pay for the right to exercise it, but you have no obligation to do so. When you sell an option, it's the opposite—you collect. Call Option definition - What is meant by the term Call Option? meaning of IPO, Definition of Call Option on The Economic Times. An option contract that gives its holder the right (but not the obligation) to purchase a specified number of shares of the underlying stock at the given strike.

What Is A Job You Can Get At 13

Youth Employment & Opportunities Locator. There are many programs that can help you on your path to success. Find job placement programs, paid training, career. People age 13 or 14 may only work in jobs that are approved by Employment Standards. An employee age 13 or 14 can do the following jobs: host/hostess; cashier. 18 13 Year Old jobs available in Texas on seemetric.ru Apply to Daycare Teacher, Childcare Provider, Tutor and more! For specific questions you might have around Ohio work permit laws and labor laws in Ohio, speak with an employment attorney. They can offer advice and insight. If you have dropped out of school, to get a full-time employment certificate Work on a Farm. If you are 12 or When you do not need to attend. Employers often won't hire someone who doesn't have the majority of the skills, education, or job experience necessary for the position. If you need to boost. We have jobs for year-olds available. Sign up and upload your CV and start applying for jobs for year-olds today in the UK. Certain agricultural jobs year-olds can hand-harvest berries, bulbs, cucumbers, and spinach during weeks that school is not in session. Harvest of any. If you have dropped out of school, to get a full-time employment certificate Work on a Farm. If you are 12 or When you do not need to attend. Youth Employment & Opportunities Locator. There are many programs that can help you on your path to success. Find job placement programs, paid training, career. People age 13 or 14 may only work in jobs that are approved by Employment Standards. An employee age 13 or 14 can do the following jobs: host/hostess; cashier. 18 13 Year Old jobs available in Texas on seemetric.ru Apply to Daycare Teacher, Childcare Provider, Tutor and more! For specific questions you might have around Ohio work permit laws and labor laws in Ohio, speak with an employment attorney. They can offer advice and insight. If you have dropped out of school, to get a full-time employment certificate Work on a Farm. If you are 12 or When you do not need to attend. Employers often won't hire someone who doesn't have the majority of the skills, education, or job experience necessary for the position. If you need to boost. We have jobs for year-olds available. Sign up and upload your CV and start applying for jobs for year-olds today in the UK. Certain agricultural jobs year-olds can hand-harvest berries, bulbs, cucumbers, and spinach during weeks that school is not in session. Harvest of any. If you have dropped out of school, to get a full-time employment certificate Work on a Farm. If you are 12 or When you do not need to attend.

Generally, if you're under 13, you can only get a job in special circumstances. Once you reach the age of 13, you can do light work. This means that you. If you are 14 or 15 years old, you can only work outside of school hours. The federal youth employment requirements limit the times of day and the number of. If you already have a DWD ID that you used to work with another When can my child begin working if I get their work permit online? How do I. Child labor laws limit the hours workers under 18 can work and the kinds of jobs that they can do. State law also requires employers to have Youth. You could advertise him on Facebook as a baby sitter, dog Walker, window cleaner, car cleaner etc just errand based jobs that are cash in hand. A minor can get a completed work permit from the school the minor attends. You can visit any GDOL Career Center to get help in finding a job. Georgia. Minors ages 12 and 13 may engage in farm labor at any agricultural establishment at which the minor's parents are employed. At any age, minors may work in any. What you'd do: Babysitting is one of the most common jobs for teens, as it demonstrates responsibility. As a babysitter, you'll watch kids, play with. Once a person is 18, they are considered an adult. The Texas Child Labor Laws make sure a child is not working in a job or way that could harm the child's. Go follow my insta @thebraceprint Where Can You Work At 13, Jobs For Jobs Best Ways To Make Money At 13 · How To Earn Money · Easy Ways To. Browse NEW YORK CITY, NY NO EXPERIENCE TEEN jobs from companies (hiring now) with openings. Find job opportunities near you and apply You will gain hands. 3. What Jobs Can I Do? Plenty! From babysitting (no working papers needed there) to working in retail or restaurants (with limitations. Jobs for 13 Year Olds by State · Restaurant worker · Musical performer · Be employed in the family business · Babysitter · Dog walker/pet sitter · Newspaper. I am 13 just about 14 looking for a babysitting job. i have been working with kids 3-up for 5 years as a karate instructor. so, i know a thing or. Find information that will make it easy for you to find out where to go for working papers, safety and health on the job, and filling out job applications and. As a library assistant, you will help visitors find and check out books. Additional duties might include helping librarians do inventory, shelving books, or. Let's get this out of the way: No test can guarantee it'll tell you your “dream job” or your forever career. These quizzes will ask you about your values. You can save a search to automatically look for new jobs that match your search criteria. Just name your job search, tell us how often you want to get. Unfortunately, if you're 13 or younger, you are not yet at the legal age to start work. You won't be able to legally work a traditional part-time job. If you. Teens who are years old can work non-school week hours if they: Agricultural jobs can include raising and harvesting crops, handling livestock, farm.